Array

New York, United States — Silicon Valley Bank’s stunning collapse has led to the freezing of tens of billions of dollars stored there by startups and their private equity backers, raising fears of a wider tech sector fallout.

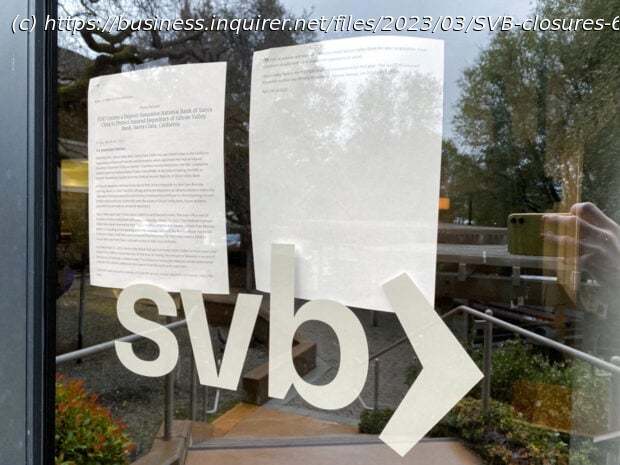

The company, whose website says it is “the financial partner of the innovation economy,” was taken over Friday by the US Federal Deposit Insurance Corporation (FDIC) to prevent further damage.

“SVB knew the entrepreneurial community,” Joseph DeSimone, a professor at Stanford University and founder of several startups, told AFP.

“They helped us recruit people, helped with securing mortgages for transplants, gave financial advice to new executives… So their disappearance is a real loss,” he said.

The company previously boasted that “nearly half” of technology and life science companies that had US funding banked with them, leading many to worry about the possible ripple effects of its collapse.

For banks that are FDIC-insured, only $250,000 per account is guaranteed.

But according to SVB’s latest annual report, 96 percent of its total $173 billion in deposits was uninsured.

The FDIC said Friday that all accounts would quickly get access to the insured portions of their deposits, but that the rest would depend on how much is recovered from sales of the bank’s assets, an often lengthy process.