Biden’s plan will raise taxes on individuals earning as little as $30,000 annually by 2027, but that’s just a trick to make the overall cost of the bill look lower than it really is.

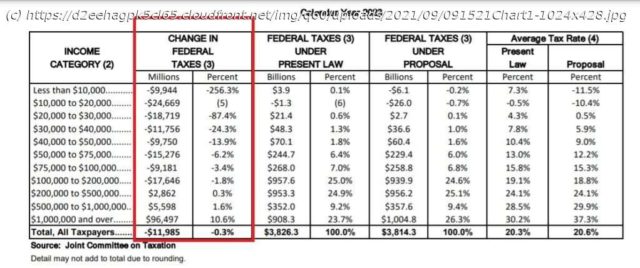

Central to President Joe Biden’s plan to hike federal spending by $3.5 trillion is a promise that middle-class Americans won’t face a tax increase. That’s a claim that is looking less and less true with each passing day. The bill Congress is drafting to pay for all that new spending includes tax hikes on tobacco products, electronic cigarettes, and cryptocurrencies —taxes that will apply to the rich and poor alike. And while the bill does not raise income taxes on anyone earning less than $200,000 annually in the immediate future, Americans earning as little as $30,000 could face a tax hike by 2027 under Biden’s plan, according to an analysis published Tuesday by the Joint Committee on Taxation (JCT), a nonpartisan number-crunching agency housed inside Congress. The culprit for that future tax increase is the expanded child tax credit, which the House tax plan would extend through 2025 (the JCT’s report only provides estimates for every other year, so 2027 is the first child tax credit–less year included in its analysis). More accurately, the culprit is Congress’ unwillingness to address the full cost of that tax credit in this bill. By promising to raise taxes later, Democrats are able to manufacture about $700 billion in «savings» that will likely never materialize. Let’s back up a little. The new JCT report shows that taxpayers earning less than $200,000 annually would see a net tax cut in 2023 under the changes that the House Ways and Means Committee unveiled earlier this week. The House Democrats’ plan would shift the tax burden toward wealthier Americans next year, largely because of how Biden’s proposal relies on hiking income tax rates for high earners and raising the capital gains tax rate, which is applied to investment earnings. Skip ahead to 2027, however, and things look quite a bit different. By then, the changes House Democrats are now proposing would result in higher taxes for nearly all taxpayers—even those making as little as $30,000 per year.