There’s no substitute for the depth and breadth of information in a book that’s written by a successful person with a specialized point of view. Instead of quick fixes and hacks that rely on current trends, each of these 12 best-selling personal finance classics promote concepts that stand the test of time.

There’s no substitute for the depth and breadth of information in a book that’s written by a successful person with a specialized point of view. Instead of quick fixes and hacks that rely on current trends, each of these 12 best-selling personal finance classics promote concepts that stand the test of time.

We listed these books by financial goals for 2017, so you can pick and choose. Or you can read all 12 — say, one each month — to really grow your knowledge of personal finance from many different angles.

Read: The Total Money Makeover by Dave Ramsey

Dave Ramsey’s ideals and advice are an extreme example of a debt-free lifestyle, but learning that the key to success is a laser focus on one goal at a time made all the difference. Diluting your efforts makes it take much longer to see results, making it more likely you will give up, Ramsey says. The first of these goals is saving $1,000 cash in a starter emergency fund, and he outlines how to do it.

The second is paying down debt using the “debt snowball” method, which we love because it pays off the smallest credit card first, again giving you that feeling of accomplishment and also freeing up money from that monthly payment to go to the next smallest balance card. And you can’t beat the sheer volume of debt payoff success stories that outline how they did it.

Read: The Automatic Millionaire by David Bach

We think David Bach coined the term “The Latte Factor” over a decade ago because he plainly illustrated the value of that same daily $2.50 spent on coffee (or whatever else) if saved and invested over 10, 20, or 40 years. Even though he wrote the book when interest rates for savings vehicles were quite a lot higher, the wisdom still applies.

He was also the first loud proponent of automatic bill pay, always paying yourself first (so savings start sooner rather than later) along with your bills so you never miss a payment, incur a late fee, or get any type of late payment penalty such as a ding to your credit score.

Read: Rich Dad, Poor Dad by Robert T. Kiyosaki

His business bankruptcy and lawsuit trouble aside, what we took away from this book is a new thinking about assets and liabilities. “An asset is something that puts money in my pocket,” Kiyosaki writes. “A liability is something that takes money out of my pocket. ” If you buy an expensive car and pay a big loan payment, it never puts money back in your pocket, so it is actually a liability.

By this view, even purchasing real estate (which most people view as their greatest asset) must be with an eye toward future value or current rental income. And you cannot depend on that future value. If you already took the equity out, or have no equity, or are upside down on your mortgage, you can see how it can quickly turn into a liability as well as how values can plummet, as so many found out when the real estate market crashed beginning in 2006.

We also learned from Kiyosaki that in real estate, to always be looking and to make a lot of low offers.

Read: Your Money or Your Life by Vicki Robin and Joe Dominguez

In this book, you’ll learn to evaluate whether your career choices are costing you “life energy,” and whether your job and spending are really in alignment with your life goals and values. When you do the math as laid out in the book, you may see your “true” hourly wage driven down in an eye-opening way. You can also see how you might be wasting time and money on things that aren’t really important to you at all.

Read: Think and Grow Rich by Napoleon Hill

In Think and Grow Rich, originally written in 1937 and based on interviews of more than 500 wealthy people of that time, Hill lays out the secrets he uncovered, arranged in 13 steps. What really spoke to us was a chapter about persistence. Do not miss the chapter called “The Devil’s Workshop. ”

Read: The 7 Habits of Highly Effective People by Stephen R. Covey

For anyone who is committed to changing a habit or reaching a goal, this book is a must-read. In it, you’ll learn that to successfully change any habit, you need not only the very strong desire to do it, but also the knowledge of how to do it and the skill to do it. And it all starts with how you view the world, yourself, and the people around you. You might be thinking, “Just tell me the seven habits already,” so if you want to know, get the book.

Read: The Money Book for the Young, Fabulous & Broke by Suze Orman

Need a book to give your young adult kids as they get their first jobs and move out on their own? A book that would answer any financial questions they might have, such as “What should I do about this 401(k) I was offered at my first job? What even is a 401(k)? ” This tome outlines the basics for every financial problem, choice, or term young adults might come up against. We especially liked her list “Don’t Do It,” as well as her usual spiel, “People first, then money, then things. ”

Read: Linchpin by Seth Godin

If you have any career aspirations, this is the book for you. In this book, you’ll learn that in order to be indispensable to the company you work for (thus, not fireable), you have to contribute something special that no one else does. You’ll learn that just doing the job as it’s written makes you a cog in the big wheel, as replaceable as any other cog. And who wants to just be a cog? The other thing we loved learning about in this book is how your “lizard brain” controls your daily thoughts and actions, and how to resist it.

Read: The Millionaire Next Door by Thomas J. Stanley, Ph. D., and William D. Danko, Ph. D.

The majority of the wealthy in America don’t live the stereotypical way we think they do, according to research conducted over the 20 years prior to the publication of this book in 1996. The authors studied the results of surveying and interviewing over 11,000 high-net-worth or high-income individuals and more than 500 millionaires to come to this opinion.

The secret that spoke most to us was, “They believe that financial independence is more important than displaying high social status. ” If you’re a data geek, this book is for you.

Read: The Way to Wealth by Benjamin Franklin

What could be more classic than a book written by Benjamin Franklin more than 200 years ago? What struck us in this book was Franklin’s connection between being debt-free and being independent. And who wants to give up their independence just to buy stuff?

Read: The Intelligent Investor: The Definitive Book on Value Investing by Benjamin Graham

The smartest thing we learned from this classic, originally published in 1949, is to take a long-term view of investing. If you have neither the time nor interest in researching a stock purchase to see that it meets a set of value-investing criteria, then you should stick to index funds or mutual funds.

This book’s basic advice has guided many investors solidly to this day because it urges you to never skip any part of the research process when making a purchase. Get the revised edition, which includes more modern perspectives.

Read: How to Win Friends and Influence People by Dale Carnegie

Why is this book on a list of personal finance books? Because without other people’s cooperation, you cannot be successful at work or with your finances. The lessons encourage you to shift your thinking and relate differently to people, and the many stories show how they work. For example, the book advises you to forget about what you want and what you want to say, and focus on the needs and wants of the other person and listen. That, and not to criticize.

This book has a lot of advice you can put into place immediately, but it takes time for these ways of interacting to become habits. This book is a must if you’re in any kind of sales position — or want to have friends!

Whether these books were written 100 years ago or very recently has no bearing on the basic financial concepts described. And it doesn’t matter whether you agree with every concept outlined or every author’s opinion. Find what you like, what might work for you, and leave the rest.

This story originally appeared on Dealnews.com .

© Source: http://www.csmonitor.com/Business/Saving-Money/2017/0109/Try-these-personal-finance-books-for-a-richer-2017

All rights are reserved and belongs to a source media.

There’s no substitute for the depth and breadth of information in a book that’s written by a successful person with a specialized point of view. Instead of quick fixes and hacks that rely on current trends, each of these 12 best-selling personal finance classics promote concepts that stand the test of time.

There’s no substitute for the depth and breadth of information in a book that’s written by a successful person with a specialized point of view. Instead of quick fixes and hacks that rely on current trends, each of these 12 best-selling personal finance classics promote concepts that stand the test of time.

Expecting a baby? Congratulations! Better put plenty of money in your savings account.

Expecting a baby? Congratulations! Better put plenty of money in your savings account.

The bond market is wrestling with the Trump trade — and could continue to do so until the incoming administration and Congress can provide more details about their programs — particularly tax reform.

The bond market is wrestling with the Trump trade — and could continue to do so until the incoming administration and Congress can provide more details about their programs — particularly tax reform.

Long before Donald Trump campaigned on the promise of banning Muslims from entering the U. S. or creating a registry for those who already live here, there was a master fear monger who made the president-elect’s divisive rhetoric seem like child’s play.

Long before Donald Trump campaigned on the promise of banning Muslims from entering the U. S. or creating a registry for those who already live here, there was a master fear monger who made the president-elect’s divisive rhetoric seem like child’s play.

As the screening date of Disney’s live-action film of “Beauty and the Beast” fast approaches, many dolls resembling Belle and Beast have popped out of stores in the US.

As the screening date of Disney’s live-action film of “Beauty and the Beast” fast approaches, many dolls resembling Belle and Beast have popped out of stores in the US.

The Crown star Claire Foy (centre) and other cast and crew members celebrated the Netflix show’s double win.

The Crown star Claire Foy (centre) and other cast and crew members celebrated the Netflix show’s double win.

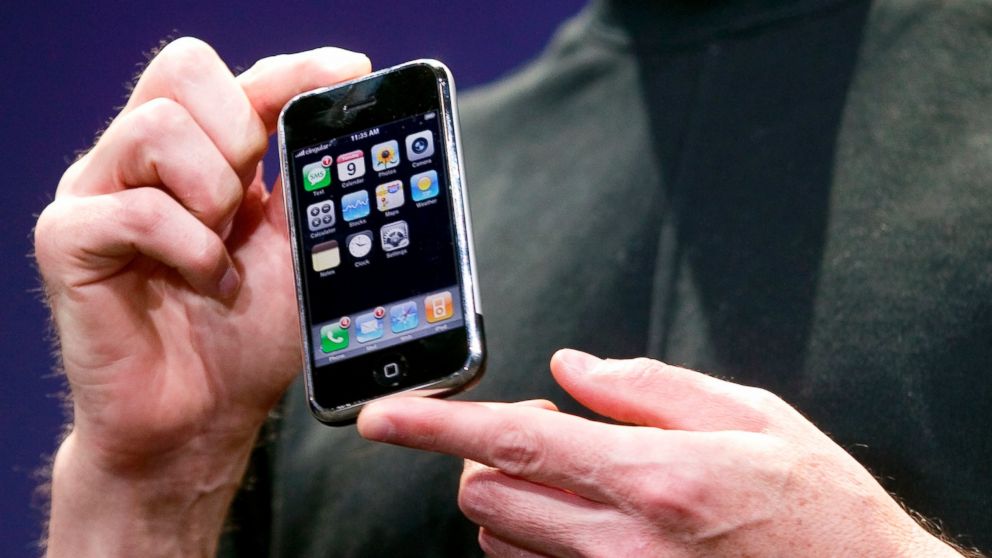

Steve Jobs promised on Jan. 9, 2007, at the Macworld convention in San Francisco that he and the crowd together would “make some history together. ” Tens years later, and over a billion units sold, it’s become clear how the iPhone has profoundly changed the way that consumers interact with their phones.

Steve Jobs promised on Jan. 9, 2007, at the Macworld convention in San Francisco that he and the crowd together would “make some history together. ” Tens years later, and over a billion units sold, it’s become clear how the iPhone has profoundly changed the way that consumers interact with their phones.

Productivity, or more precisely the lack of productivity, is one of the great puzzles of the British economy at the moment.

Productivity, or more precisely the lack of productivity, is one of the great puzzles of the British economy at the moment.